The seven best budgeting and savings apps every Aussie needs

Article by Mozo©

Imagine a budgeting tool so good it fits snuggly in your pocket.

With the roll out of new banking apps from neobanks and existing players, more Australians use smartphones to manage their money everyday.

Tracking expenses? Check. Budgets made easy? Check! Smash saving goals? That's a big ol' checkity-check.

But what are your options? To help you get started, here’s a list of seven Australian apps which can help you budget, save, and manage your money, all from your smartphone.

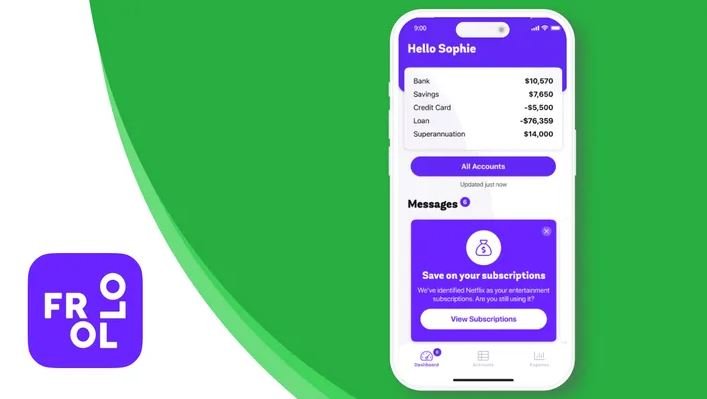

1. Frollo

- Sync accounts from 100+ banks, super funds and financial providers

- Budgeting, automatic categorisation and bill tracking

- Ongoing insights and customised ‘Frollo score’

The Frollo app from fintech Frollo is one of the more advanced money management tools available to Australians, with users able to link everything from bank accounts and home loans to superannuation from 100+ financial institutions to get a comprehensive financial overview in the one place. Frollo is also one of the first adopters of open banking, which means they can provide near real-time data to customers from participating banks.

Among its most useful features the app allows users to set up their own budgets, set and track goals and make use of customised insights, plus spending is also automatically categorised and there’s even a bill tracking feature which alerts users before they come in. Frollo was even named best Money Management App at the 2023, 2022, and 2021 Mozo Experts Choice Awards for Bank Accounts and Savings

2. Beem

- Split bills and send instant payments

- Track shared expenses

- Shopping rewards

Newly rebranded, this flagship payment app bills itself as the solution to the awkwardness of IOUs. Send and request automatic payments to anyone with a Beem handle and let the app do the rest with lightning quick efficiency. It’ll even nudge slowpokes with friendly reminders (and funky fun gifs) so you don’t have to.

Backed by eftpos and top-notch security, Beem can be a great and secure way to track life’s shared expenses, whether it’s travel, food, house sharing, or more. You can even browse online or in-store shopping deals and accumulate cashback with every purchase (just watch out for T&Cs).

3. Spriggy

- Secure money management app for families

- Set savings goals and track spending

- Flexible payment options

Looking to give your kids pocket money, but in the 21st century? Spriggy could be the ticket. Designed to give caregivers and families a 360-degree view of their children’s finances, Spriggy helps you track your kids’ spending, teach them money management skills, and even loads cash onto a debit card so they can eat or get home in a pinch.

Better still, there’s a ton of security features and safety nets (like spending restrictions and a pause/lock function) so your kiddly-winks can’t accidentally – or purposefully – get into mischief. You can set tasks or jobs so they can earn their allowance or watch as they meet visual savings goals. Financial literacy FTW!

4. Finspo

- Link accounts from over 100 banks and financial institutions

- Discover your ‘true’ banking costs

- Ongoing personalised insights and check ins

Unlike the apps above which are aimed at providing a more ‘whole of finance’ approach, the Finspo app is all about shining a spotlight on the costs of banking. To do that users can sync up their home loans, credit cards, bank accounts and savings accounts from over 100 Australian banks and institutions, then Finspo will analyse that financial data and provide a range of personalised insights on an ongoing basis.

What kind of insights you ask? Well Finspo reckon that many Aussies don’t get the full memo when it comes to banking costs, so they’ll break down all the various fees and interest you’re actually paying then show you how much you could actually save by switching to a better value product. For example, the amount you could save each month by opting for a home loan with a lower interest rate.

5. Flux

- Find out and track your credit score

- Personalised insights

- Additional money saving content

What’s the deal with credit scores? We don’t blame you if you don’t know a whole lot about them because, frankly, they can be a little bit confusing. Simply put, a credit score (or rating) is used by lenders and other financial providers to determine how risky you are as a borrower.

That’s where Flux comes in, because the Flux app can reveal to users exactly what their credit score is. The app could also prove handy for those looking to improve their credit health, because Flux also provides users with monthly updates to show them how their credit score is tracking over time as well as personalised insights to show you what’s moving the score up or down.

6. WiseList

- Compare grocery prices side-by-side

- Set up item price alerts

- Extra bill management feature

WiseList is a money saving app with a difference. Aimed at helping Aussies save money at the checkout, WiseList lets users create grocery lists then compare item prices from both Coles and Woolworths side-by-side - after all, one secret to saving money is planning (especially when it comes to shopping). Heckin' useful for crushing the rising cost of groceries!

Among the other app features, lists can be made collaboratively between family members, alerts can be set up for specific items to alert you when they go on special and Flybuys and Woolworths Rewards cards can be added to the app to use at checkout. WiseList even has a separate bill management feature which lets users take photos of their bills, automatically pulls out the most important information and then sends out an alert when it’s due.

7. WeMoney

- Pay off debt

- Join accounts from 400+ financial institutions

- Set and track savings goals

Drowning in debt? WeMoney could throw you a rope. Marketed as a free “social financial wellness” app for tracking and crushing debt, WeMoney empowers users with community tips and modern technology so they can take charge of their finances.

Armed with a suite of features, users can keep track of bills, cancel any sneaky subscriptions eating into your budget, and compare personalised deals on debt consolidation loans. WeMoney claims the average member improves their credit score by 63 points just 9 months after signing up to their service. Pretty impressive!

You can also connect accounts from over 400 banks, credit cards, supers, Buy Now Pay Later services, and more so you can get a bird’s eye view of all your money. Set savings goals and glean finance tips from other WeMoney community members for the extra debt-crushing motivation.